AI HEDGE FUND

AI Hedge Fund

What It Is

A proof-of-concept multi-agent trading system. Each agent implements a distinct investment strategy (value, technical, sentiment). A central orchestrator aggregates signals, weights by confidence, and generates trade recommendations.

This is a research project, not a live fund.

The Problem

Trading systems typically:

- Use single models or fixed rule sets

- Lack multi-perspective analysis

- Cannot explain decision rationale

- Slow to adapt to changing conditions

The Solution

Multiple specialized agents:

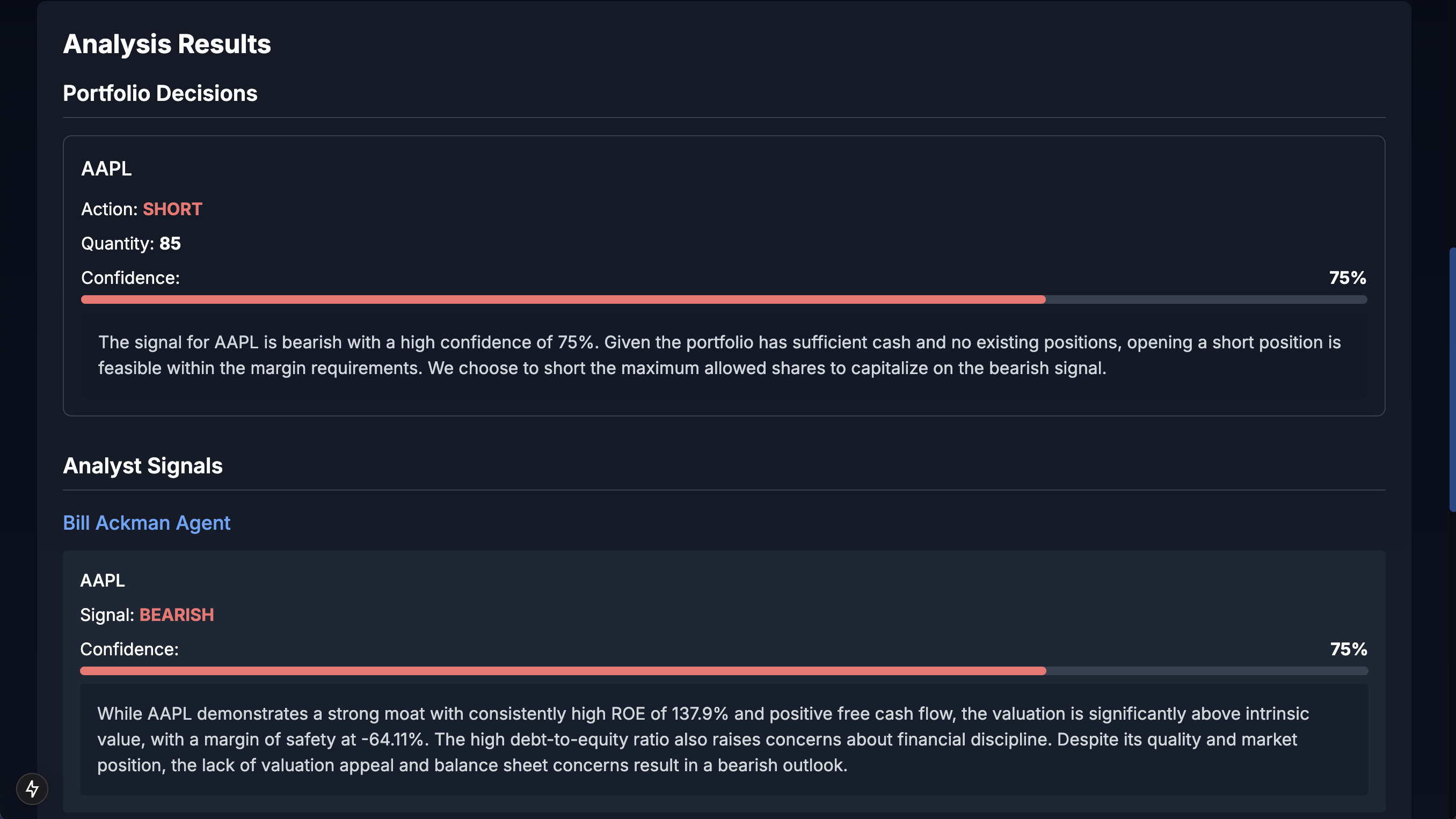

- Each agent analyzes markets using its strategy

- Signals scored by confidence

- Central aggregation weights and compares

- Dashboard shows reasoning and consensus

Agents

| Agent | Strategy |

|---|---|

| Value Agent | DCF valuation, comparables, margin of safety |

| Technical Agent | Trend detection, pattern recognition, momentum |

| Sentiment Agent | News NLP, social media analysis |

| Buffett Agent | Quality metrics, moat analysis, long-term value |

| Ackman Agent | Activist thesis, catalyst identification |

Each agent operates independently and produces confidence-scored signals.

Architecture

Agent Layer

- Containerized microservices per agent

- REST APIs for inter-agent communication

- Custom logic per strategy

Data Layer

- Alpha Vantage and Yahoo Finance for market data

- NLP pipeline for news and social sentiment

- Historical fundamental datasets

- Redis caching

Processing Layer

- Signal scoring engine

- Cross-agent comparison

- Anomaly detection

- Decision audit trail

Decision Engine

- Trade simulation

- Position sizing based on confidence

- Portfolio constraint validation

- Performance feedback to agents

Technology Stack

- Python, FastAPI, Docker

- Kafka for event streaming

- MongoDB and PostgreSQL

- LangChain and CrewAI for agent orchestration

- GPT-4, FinBERT, Mistral for reasoning

Development Status

| Milestone | Target | Status |

|---|---|---|

| Core agent framework | Q2 2025 | Complete |

| Technical and valuation agents | Q2 2025 | Complete |

| Sentiment and strategy agents | Q3 2025 | In Progress |

| Signal dashboard | Q3 2025 | Planned |

| Portfolio simulation | Q4 2025 | Planned |

| Risk management engine | Q4 2025 | Planned |

| Live execution | Q1 2026 | Planned |

Use Cases

Signal Research Analyze agent consensus and individual signal performance.

Strategy Testing Plug in custom agent logic and compare against existing agents.

Education Understand multi-factor analysis through transparent reasoning.