PORTAL AGENTS MARKETPLACE

Portal Agents Marketplace

Open Marketplace

LaunchWhat It Is

Portal Agents Marketplace hosts AI agents that execute blockchain operations via natural language. Users describe what they want. Agents analyze options, propose actions, and execute approved transactions.

Each agent specializes in a domain: DeFi transactions, contract analysis, yield farming, or trading. All agents are non-custodial. Users sign transactions in their own wallet.

The Problem

Blockchain operations require:

- Protocol-specific knowledge for each DeFi platform

- Manual monitoring of yield rates across chains

- Transaction construction and gas optimization

- Contract analysis for security assessment

- Position management across multiple protocols

The Solution

Agents handle the complexity:

- Natural language input for operation requests

- Multi-protocol analysis and comparison

- Transaction preparation with gas optimization

- User approval before execution

- Continuous monitoring of positions

Live Agents

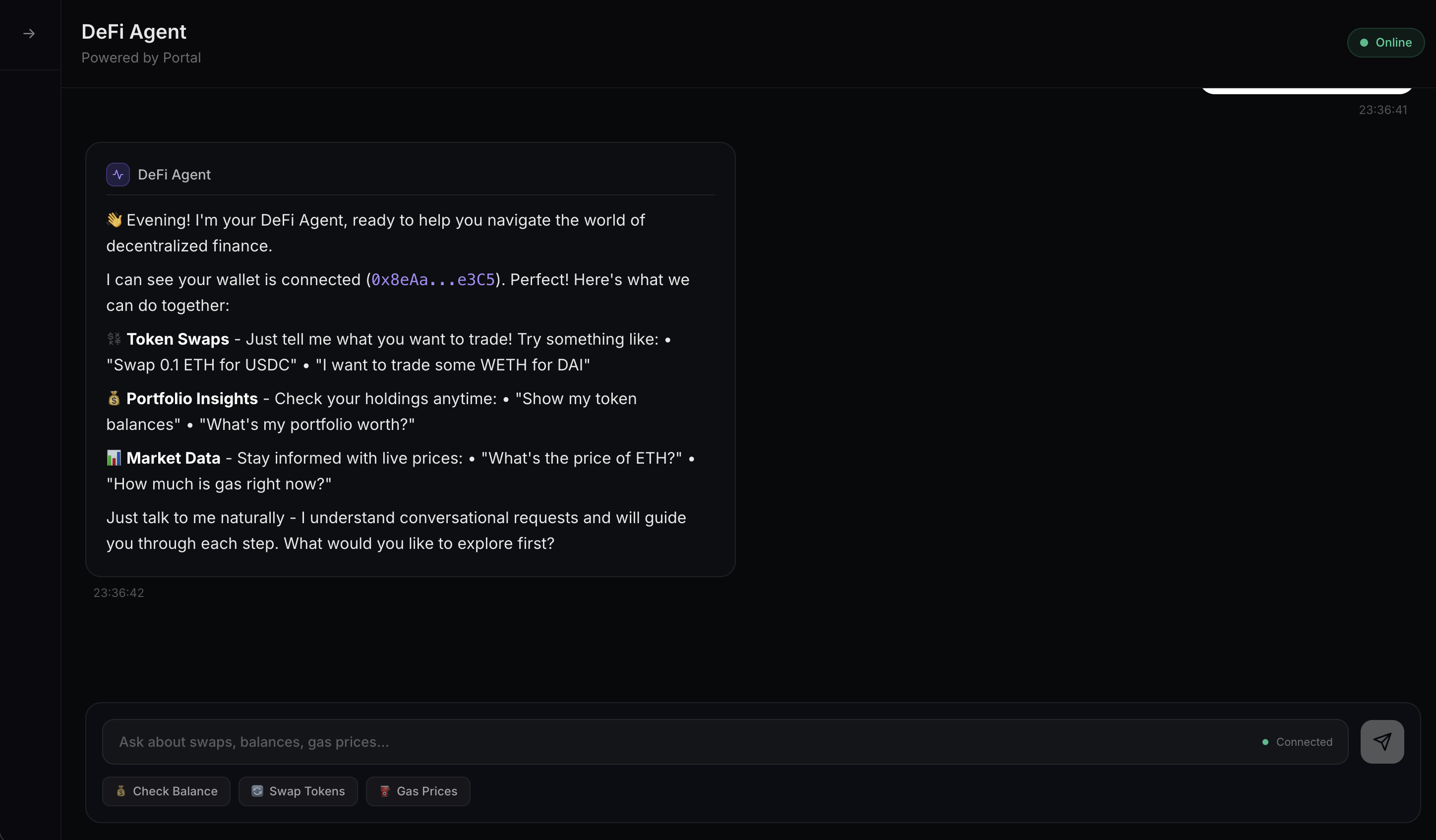

DeFi Agent Executes swaps, lending, and borrowing across Aave, Compound, and Uniswap. Integrates with 0x for swap routing. Handles gas optimization and transaction batching.

Smart Contract Reader Analyzes contract source code and transaction history. Provides security assessment, function documentation, and risk scoring. Uses Etherscan and Moralis APIs.

Yield Harvester Scans yield opportunities across chains via DefiLlama. Compares APYs, assesses protocol risk, and prepares migration transactions. Supports Compound v3 and Aave v3.

Planned Agents

| Agent | Function | Target |

|---|---|---|

| Privacy Swap | Zero-knowledge swaps via Railgun | Q4 2025 |

| Cross Chain Swap | Multi-chain bridging with route optimization | Q4 2025 |

| Perps Trading | Leverage trading on Hyperliquid and dYdX | Q1 2026 |

| Whale Scout | Large wallet tracking and sentiment analysis | Q1 2026 |

| Governance Steward | DAO proposal monitoring and voting | Q1 2026 |

| LP Optimizer | Uniswap v3 and Balancer position management | Q1 2026 |

Technical Architecture

DeFi Agent

- 0x Protocol for swap routing

- EIP-712 signature handling

- Multi-provider Web3 connectivity

- Token registry with address resolution

Smart Contract Reader

- Moralis API for blockchain indexing

- Etherscan for source verification

- OpenAI for code analysis

- Caching layer for metadata

Yield Harvester

- DefiLlama for yield aggregation (200+ protocols)

- Direct Compound v3 and Aave v3 integration

- Risk-adjusted yield calculations

- Protocol categorization

Communication Framework

- WebSocket for real-time updates

- Persistent conversation context

- Error recovery with fallbacks

- Client-side transaction signing

Security Model

Agents do not:

- Store private keys

- Sign transactions

- Hold custody of assets

- Execute without user approval

All transactions require explicit user signature. Agent actions are logged and auditable. Emergency shutdown available for all agents.

How to Use

- Connect wallet

- Select agent from marketplace

- Describe operation in natural language

- Review agent proposal

- Approve and sign transaction

- Monitor execution

Development Status

| Milestone | Target | Status |

|---|---|---|

| Core agents (DeFi, Contract Reader, Yield) | Q3 2025 | Live |

| Privacy and cross-chain agents | Q4 2025 | In Progress |

| Trading and analytics agents | Q1 2026 | Planned |

| Community agent marketplace | Q2 2026 | Planned |

| Custom agent builder | Q2 2026 | Planned |